Fund Tracking for Nonprofits

At Cougar Mountain Software, we are very excited to be a new addition to the NeonCRM family. With Denali FUND and NeonCRM’s donor management program, you not only get true fund accounting software for your organization, but you also get all the benefits of NeonCRM’s complete donor management solution.

NeonCRM gives you a variety of features that integrate with Denali FUND such as:

- Importing recurring, anonymous, and memorial donations directly into General Ledger

- Tracking grant applications

- Managing donor relationships, running campaigns, and tracking volunteers

- Accessing NeonCRM through any device with internet access

- Collecting donor information and payments through web-based forms

With all the new information you receive from using NeonCRM, you’ll need to be sure you can easily manage each donation. Denali FUND’s built-in fund tracking capabilities show exactly where every penny is being moved, spent, or saved. You can pull a Revenue and Expense report at any time to get an overview of the total monies coming in and going out of the organization’s varying funds.

Working for a nonprofit organization can be one of the most rewarding jobs in the world. For many in the nonprofit industry, nothing matters more than doing good work, but to make that good work worthwhile, your organization needs to keep track of what is coming in and going out. This means you need detailed and manageable fund accounting.

Why do you need detailed fund tracking?

A key part of working for, or with, any nonprofit organization is to remember that a nonprofit uses fund accounting which emphasizes accountability rather than profitability. This means that no matter where money comes from, be it a grant or donation, every penny must be accounted for. This is especially important because potential donors will want to know their money will be invested in an organization that uses its donations wisely.

Most funds are separated into two categories, those with restrictions and those without restrictions. It’s important to know which funds are restricted or unrestricted when you set them up. Restricted funds can only be used for a specified purpose. Unrestricted funds can be used for any purpose at the discretion of the organization. Remember, fund accounting is about accountability, making sure the board of directors knows what is happening to the money coming in and going out of the organization, plus where it is being spent. By using Denali FUND’s built-in fund tracking features, the trust you gain with those on the board, as well as other outside parties, grows.

What reports are required for a nonprofit organization?

Within your organization you’ll need all kinds of reports to show the health of your organization. But there are three key reports that are required by the Financial Accounting Standards Board (FASB) for a nonprofit organization, and they are included in Denali FUND. They are the:

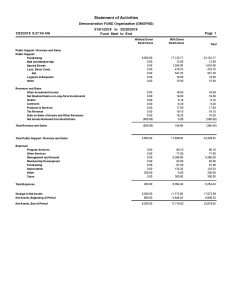

- Statement of Activities

- Statement of Financial Position

- Statement of Cash Flow

According to their website, FASB is a “private, nonprofit organization whose primary purpose is to establish and improve generally accepted accounting principles (GAAP) within the United States in the public’s interest. The intent and purpose of FASB requirements are to bring a measure of uniformity to the financial statements of nonprofit organizations.”

Many times FASB reports can also be used internally, though their primary function is for external viewers such as investors, donors (current and potential), and the government.

Each report has its own function to show the current financial state of a nonprofit organization. For a report to be considered FASB compliant, it must show the fund amounts as restricted or unrestricted.

For example, the Statement of Financial Position shows an organization’s assets, liabilities, and net assets separated into “with donor restrictions” or “without donor restrictions.”

The Statement of Activities shows the changes made in restricted and unrestricted net assets.

Finally, the Statement of Cash Flow demonstrates an organization’s inward and outward flow of cash.

At Cougar Mountain Software we are nonprofit-loving, organization-obsessed, accounting perfectionists. We understand accounting for every penny can be difficult, which is why we developed our on-premises accounting solution, Denali FUND. Denali FUND not only gives you a leading accounting solution, but you can track each fund individually and have peace of mind with FASB compliant reports.

To learn more about our integration with NeonCRM click here!

Trackback from your site.