The Thing about Fraud Deterrence…

“How do you encourage good behavior and discourage bad behavior?” asks Denise McClure, CPA, CFE, in our 2nd webinar about fraud prevention, “By heightening the risk of consequences for that bad behavior.”

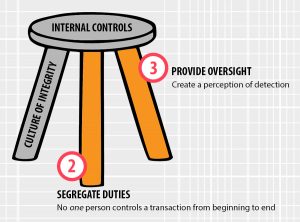

Internal controls are a three-legged stool. The first leg — a culture of integrity — is discussed in the 3rd webinar. The second leg is segregation of duties, which ensures that no one person controls a transaction from beginning to end. The third leg of the stool is the necessary provision of oversight. Easing into a disclaimer, Denise explains, “How you implement checks and balances in your organization will be different based on what kind of accounting system you have, the skills and abilities of your employees, and several other factors. There is no one, right way to do it.” It’s a classic Goldilocks scenario. Too many internal controls can lead to a paranoid work environment, inefficient processes, and ‘handcuffed’ employees who don’t have enough maneuverability or trust to do their jobs. Too few internal controls, and there is a loss of respect for the organization, lethargic job performance, and — the subject of the second webinar — a perceived opportunity to capitalize on that disorganization and dysfunction by committing a fraudulent offense with a minimal chance of being caught.

“Trust but Verify is about freeing your employees of suspicion by removing the temptation to behave inappropriately.”

Denise spent much of her time explaining and building a case for the Trust but Verify approach. In an effort to avoid spoilers and improve understanding of the material, the team at Cougar Mountain Software brainstormed the following scenario to articulate the TbV method. (You can listen to Denise’s description here instead.) Imagine a couple, after 5 years of marriage, decides to part ways (amicably, for the most part). “Partner A” does not believe “Partner B” is capable of theft, destruction of personal property, or inflicting physical harm on anyone. Ever. But to protect the character of Partner B, Partner A (who kept the house), chooses to change the locks and install a security system. Most importantly, Partner A notifies Partner B of the updates. So, now, should something go missing, perhaps a favorite mug or sentimental heirloom, Partner A won’t have to wonder if Partner B is responsible. Instead, Partner A will direct their energy towards locating the misplaced item, retracing their steps, and/or identifying the true culprit (likely as innocuous as carelessness). Partner B is exonerated before the crime is committed, their culpability never even coming into question. In an organization, Trust but Verify is considerably more effective and necessary than in this rudimentary illustration. Implementing rules that reduce criminal opportunity creates a work environment free from doubt, fear, and (what would otherwise be) hidden activity. It’s been proven that people behave differently when we believe we are being watched. Often just the possibility is enough to motivate us to behave differently. It’s a universal human instinct, and part of what makes Trust but Verify so effective as a strategy of deterrence.

To help create a perception of detection in your organization, Denise offers 4 specific tips:

- Review bank statements and credit card statements.

- NEVER sign checks without reviewing full supporting documentation.

- Make sure that someone independent of related processes receives the mail, prepares the deposit, and creates a ‘log’ of receipts.

- Perform in-depth reviews of entries and supporting documents.

Replay the webinar here for detailed descriptions and examples of each tip. (This also includes a recap of the infamous mother/daughter fraud team that took a nonprofit for 1.5 million — an open and closed case of non-existent internal controls.)

“Your employees know where weaknesses are in your organization. What we’re trying to do is counter that perception of opportunity, and replace it with a perception of detection.”

“Keep honest people honest,” says Denise, encouraging oversight and segregation of duties. The first guarantees transparency, the latter accountability. Fraud is rampant because “you don’t know what’s going on in the hearts and minds of your employees,” she says. You don’t know the harassment, the fear, the depression they may be experiencing. The best way to protect them is to control their perception of opportunity. Don’t let ideas of “borrowing” money spring up without being tackled by four logical and inarguable reasons why it can’t be done; why they’re sure to be caught should they even attempt it. “Don’t make it too easy to cross that moral and ethical line,” Denise said in part 1 of this series. People have been known to act out of character when faced with extreme pressure or low-hanging opportunity, let alone both at the same time.

The importance of deterrence cannot be understated, but the third leg of the stool is just as critical. Think of a culture of integrity as the ‘carrot’ to the ‘stick’ of deterrence — giving your employees their dignity, motivation, and the ability to experience profound pleasure in their work. Not convinced? Watch Denise McClure’s fraud series finale to see the difference an attitude can make.

Denise has been adding up accounts and doing the math for over two decades. She provides evidence for fraud and embezzlement prosecution and has studied the behavior of hundreds of first-time fraudsters. In addition to her full-time job as a CFE, she lends her time and talent to investigating cases of elderly fraud abuse pro bono. Such cases are notoriously difficult to win because proving that a geriatric mind was or was NOT impaired at the time of an offense is a legal and practical minefield. Not to mention, court proceedings can span years and not every victim will live to see their complaint resolved. For those that manage to achieve these first two objectives, winning can still be a hollow victory as the same rule about restitution applies here as it does to corporate or nonprofit fraud offenses; very often there is no money left with which to pay the individuals back. When an expert in her field tells you the best way to recover from fraud is to never let it happen, it’s best to listen.

Learn more about Denise McClure and her company, Averti Solutions, HERE.

Trackback from your site.