“How do you encourage good behavior and discourage bad behavior?” asks Denise McClure, CPA, CFE, in our 2nd webinar about fraud prevention, “By heightening the risk of consequences for that bad behavior.”

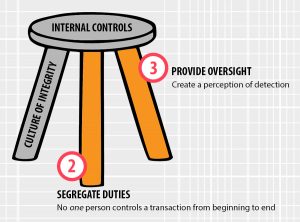

Internal controls are a three-legged stool. The first leg — a culture of integrity — is discussed in the 3rd webinar. The second leg is segregation of duties, which ensures that no one person controls a transaction from beginning to end. The third leg of the stool is the necessary provision of oversight. Easing into a disclaimer, Denise explains, “How you implement checks and balances in your organization will be different based on what kind of accounting system you have, the skills and abilities of your employees, and several other factors. There is no one, right way to do it.” It’s a classic Goldilocks scenario. Too many internal controls can lead to a paranoid work environment, inefficient processes, and ‘handcuffed’ employees who don’t have enough maneuverability or trust to do their jobs. Too few internal controls, and there is a loss of respect for the organization, lethargic job performance, and — the subject of the second webinar — a perceived opportunity to capitalize on that disorganization and dysfunction by committing a fraudulent offense with a minimal chance of being caught.

Responsibility of Board Members

Responsibility of Board Members

Embezzlement is a Pattern of Behavior, and It Doesn’t Happen Overnight

Embezzlement is a Pattern of Behavior, and It Doesn’t Happen Overnight